Bankruptcy Lawyer

If you or your business face debt that you cannot repay or credit terms you cannot meet, bankruptcy can offer a fresh start.

Our firm can determine if bankruptcy is right for your needs and help you use this option to your advantage.

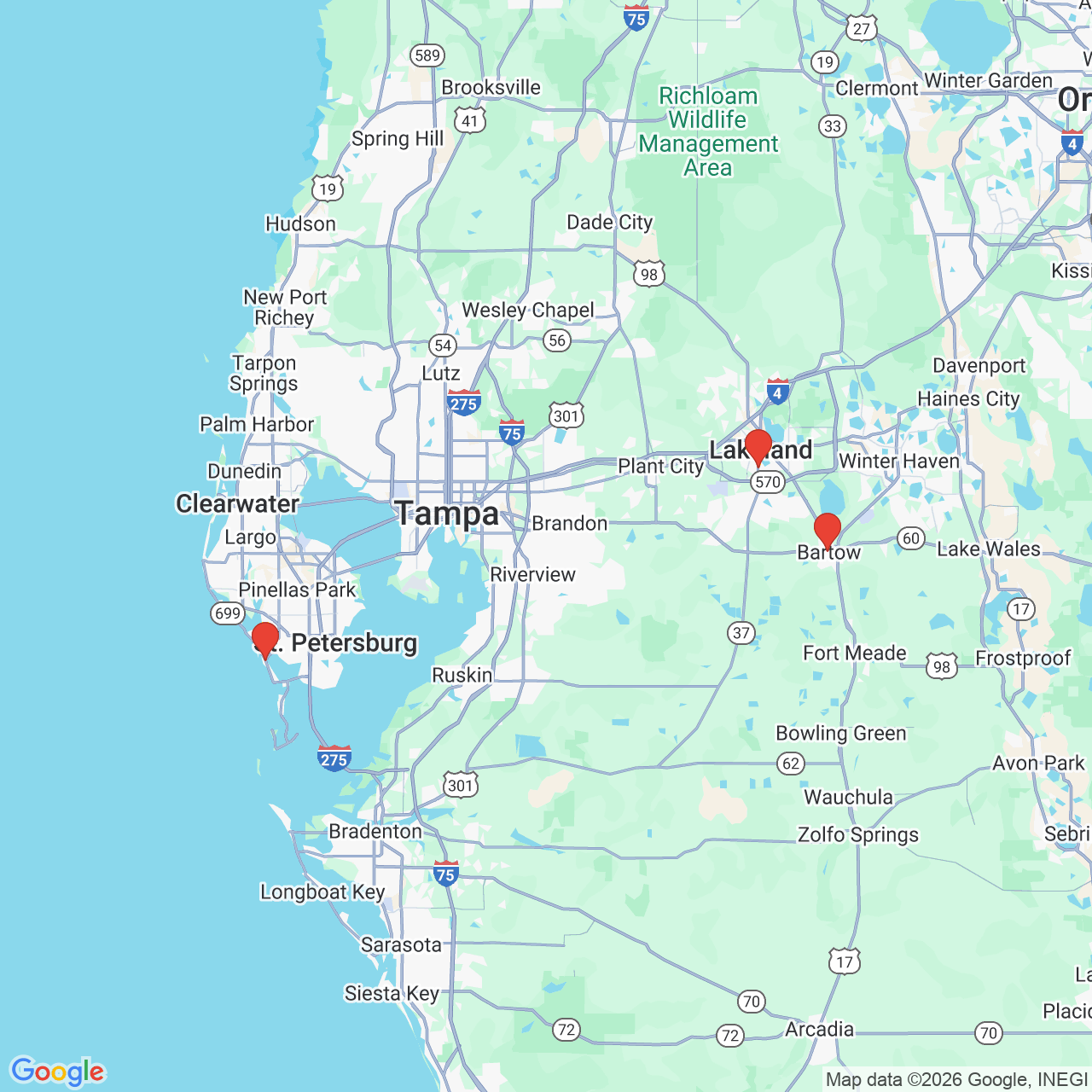

Request a consultation at one of our offices in Bartow, St. Petersburg, or Lakeland, FL, to learn how we can help you move forward.

Do I Really Need to Hire a Bankruptcy Lawyer?

Since you are already facing serious financial issues, you are probably wondering: Why spend more money on an attorney? To put it simply, bankruptcy law is incredibly complex. Having an attorney on your side can help you make the most of the protections provided by bankruptcy laws and avoid the serious consequences of making a mistake in the process. As your bankruptcy lawyer, Mr. Kovschak will:

- Determine whether it would truly benefit you to file for bankruptcy

- Determine which type is best for your needs

- Negotiate with creditors in order to keep the assets you need the most

- Prevent you from making errors that the courts could perceive as fraud

- File all paperwork in a timely manner

Our firm does not offer "flat fee" plans. Instead, we provide services to each client on an hourly basis so they pay only for the services they require. We have a consultation fee that varies depending on the type of case, with discounts available to armed forces personnel, veterans, and law enforcement. Our attorneys welcome clients from throughout Polk County and surrounding communities as well as Lakeland, St. Petersburg, and Bartow.

Bankruptcy can be the opportunity for a fresh start. Lakeland-area bankruptcy attorney Matthew J. Kovschak can help you find your best path forward.

Book Your Case Review With Bankruptcy Attorney Matthew J. Kovschak

If you are considering filing for bankruptcy, attorney Matthew J. Kovschak at Sutton Law Firm can provide valuable legal guidance. He understands that considering bankruptcy is difficult, so he gives his clients individualized attention when helping them achieve the best possible outcome in their case.

Matthew J. Kovschak is a member of the American Bankruptcy Institute and the Tampa Bay Bankruptcy Bar Association who has been practicing law for more than 35 years. When his peers face complex bankruptcy issues, they turn to Mr. Kovschak because of his ability to see beyond the ordinary solution. Whether you need to file on behalf of yourself, your small business, or your large corporation, he is here to help clients in need. Mr. Kovschak also assists creditors whose debtors file for bankruptcy.

We welcome clients from throughout Polk County and surrounding areas. To schedule a consultation with our bankruptcy attorney at one of our offices in Bartow, St. Petersburg, and Lakeland, FL, please contact us online or call:

(863) 533-8912

Matthew J. Kovschak is a member of the American Bankruptcy Institute and the Tampa Bay Bankruptcy Bar Association who has been practicing law for more than 35 years.

Debt Collectors Have a New Tool: Social Media

Under new rules passed by the Consumer Financial Protection Bureau (CFPB), debt collectors can start reaching out to struggling consumers via Facebook, Twitter, and other social media channels. Thankfully, they face some restrictions. For example, the messages must be private, meaning none of your social media friends or the public should be able to see it. In addition, you must be allowed to opt out of receiving the messages.

However, one caveat seems more like a burden on the consumer. Before collectors can report a defaulted debt to a credit agency, they must either speak to the borrower in person or by telephone, or wait 14 days after sending a letter or electronic communication. Unfortunately, social media is considered “electronic communication,” which keeps consumers on the hook for monitoring their social media for notices from debt collectors.

End the Harassment

In addition to putting you on a better financial footing, filing for bankruptcy can put an end to creditor harassment. We can help struggling consumers and businesses in Lakeland, St. Petersburg, Bartow, and throughout Polk County put their lives back on track.

"Above and beyond."

5-Star Reviews of Our Attorneys Serving Lakeland

and Cities throughout Southern Florida

I highly recommend this law firm. They provide excellent and passionate representation for their clients.

View on Google

Ms. Sutton and her partners go above and beyond to take care of their clients and their difficult cases. She has been in the area for many years and has been a part of many high profile cases. I highly recommend Sutton Law Firm!

View on GoogleWhat Are My Bankruptcy Options?

Most clients at our offices in Bartow, St. Petersburg, and Lakeland, FL, will file bankruptcy under Chapter 7, Chapter 11, or Chapter 13.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy is the most commonly filed type, and can benefit both individuals and businesses. In order to become eligible for Chapter 7, you must pass a "means test" establishing that you are not able to repay your debts to creditors. Those who file Chapter 7 bankruptcy are released from their personal liability for debts that qualify as dischargeable, such as credit card debt and medical bills. Debts that do not qualify include student loans, back child support, money owed due to having caused a personal injury, income taxes, and money owed for having broken the law (such as traffic tickets).

Under Chapter 7, certain property can be liquidated to repay creditors, while other exempt property cannot. In Florida, exemptions include up to $1,000 in personal property (such as furniture and home electronics), education savings, and tax refunds. You also get an exemption of $1,000 in car equity (or more if you are filing with your spouse), meaning your car probably won't be liquidated. For example, if your vehicle loan is worth $5,000 but the car has a value of $6,000 or less, it is exempt. If you have lived in Florida for 40 months or longer, all of your home equity is exempt as long as your property is no larger than a half-acre in a city or 160 acres elsewhere.

During a consultation at one of our conveniently located law offices, our bankruptcy attorney can determine if Chapter 7 is right for you.

With Chapter 7, there is hope for those facing insurmountable debt. Turn to Sutton Law when you need an attorney to help you file Chapter 7 bankruptcy. We have offices in Lakeland, St. Petersburg, and Bartow.

Chapter 11 & Chapter 13 Bankruptcy

Chapter 11 & Chapter 13 bankruptcy are known as "reorganization bankruptcy."

Chapter 13 is strictly for individuals with a stable income who are faced with creditors' demands for immediate repayment of loans because of overdue payments. With this option, home foreclosures, wage garnishments, and any lawsuits related to your debt will stop. Instead, you will enter into a court-approved repayment plan that consolidates all of your loan payments into single monthly installments made over a three- to five-year period. You don't have to liquidate any of your assets under Chapter 13.

Chapter 13 requires having less than $465,275 in unsecured debts (such as credit card debt and medical bills) and less than $1,395,875 in secured debts (such as a mortgage). Under Chapter 13 bankruptcy, you will remain responsible for expenses such as student loans and child support.

Chapter 11 is for businesses or individuals, but is mostly used by businesses that are making money but cannot afford their loan payments. Unlike Chapter 13, this tool has no limits when it comes to the amount of debt carried, and it can require liquidation of certain assets in order to repay creditors. However, like Chapter 13, creditors can no longer take legal action or enforce garnishments against the debtor. The debtor will propose a repayment plan subject to the approval of the creditors and the courts. Upon approval, the business can continue to operate, usually after making changes to avoid becoming overwhelmed by debt in the future.

Chapter 11 and Chapter 13 involve making a court-approved repayment plan. Bankruptcy attorney Matthew J. Kovschak can help you through this process. We have three convenient offices in Lakeland, St. Petersburg, and Bartow.

"Truly exceptional." More 5-Star Reviews of our Attorneys Serving Lakeland and Beyond

Great team, and everyone is so friendly. They've helped me out of dark times, very appreciative of the whole staff!

View on GoogleI highly recommend Sutton Law Firm. They are truly caring attorneys that take the time to listen and help explain the complexities of the law. The staff is truly exceptional. Their professionalism, attention to detail, and genuine concern for clients is evident.

View on GoogleAnswers to Frequently Asked Questions About Bankruptcy Law

Our bankruptcy attorney serving Bartow, St. Petersburg, Lakeland, FL, and beyond looks forward to answering your questions and helping you decide the best way forward. Until you are able to meet with us for a consultation, our law firm has provided answers to some of the questions our clients ask most often:

How long does Chapter 7 bankruptcy take?

Chapter 7 bankruptcy can usually be completed in about six months or less, depending on the complexity of the case, any objections to the discharge of your debt, and other factors.

How much does it cost to file for Chapter 7 in Florida?

The filing fee, administrative fee, and trustee discharge cost a total of $338. This does not include the cost of hiring an attorney; however, hiring an attorney can help you avoid costly mistakes and ensure that this process achieves the outcome you want.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

If you are eligible for Chapter 7 bankruptcy, it means you are unable to pay your debts. Chapter 13 is for parties who have the means to eventually pay their overdue debt payments, but cannot make the immediate payments their creditors are demanding.

How much does it cost to file for Chapter 13 bankruptcy in Florida?

You will have to pay an administrative fee and filing fee totaling $313. Again, this does not include the cost of hiring a bankruptcy attorney, an option that can help you achieve the best possible benefits of bankruptcy.

How long does it take to complete Chapter 13 bankruptcy?

It typically takes three to five years to complete Chapter 13 bankruptcy in Florida. When you meet with our firm serving Lakeland, Bartow, and St. Petersburg, we can give you a better idea of the timeline you can expect.

How long does bankruptcy stay on your credit report?

Chapter 7 stays on your credit report for 10 years; Chapter 13 will appear on your credit report for seven years. In both cases, they are automatically removed from your credit report once the required amount of time has passed.

Can I file for bankruptcy on student loans?

Yes; the first step is to file for Chapter 7 or Chapter 13 bankruptcy. You will then need to file for an adversary proceeding (in which you and your creditor will meet with a neutral third party), which will give you the opportunity to prove that repaying your student loans would cause undue financial hardship. An attorney can be instrumental in making this case on your behalf.

“Matt Kovschak was professional and knowledgeable.” More 5-Star Reviews From the Lakeland Area

Sutton Law Firm is awesome. Matt Kovschak was professional and knowledgeable. He went above and beyond to help us receive the outcome we desired. If your in need of a great attorney, I would highly recommended Matt Kovschak at Sutton Law Firm.

View on Google

Sutton Law is the best. Thru out my career I have worked with many law firms. I know a good one when I see it. And Sutton Law is a good one. They are professional, sincere, and approachable.

View on Google